are union dues tax deductible in 2020

You can only deduct certain employee business expenses in 2021 - the majority of these expenses are not tax deductible but there are certain employment categories which may qualify. 20 Unreimbursed employee expenses job travel union dues job education etc.

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

If the expenses are paid within the 1-year period his survivor or personal representative can file an amended return for 2020 claiming a deduction based on the 1500 medical expenses.

. For tax years prior to 2018 the IRS allows you to deduct unreimbursed work expenses including the cost of tools equipment supplies required uniforms that are unsuitable for wear outside of work protective gear professional dues such as union dues or membership to professional organizations subscriptions to professional journals and even expenses you pay. For the year 2021. In addition to school-related unreimbursed employee expenses you can include union dues investment expenses tax preparation fees and certain other expenses to get over the 2 threshold.

Only union membership dues are deductible and union members may not deduct initiation fees licenses or. Some states California for example continue to provide this tax deduction after 2017 so even though you might not get a break on your federal taxes you might save some. However the amount deductible is limited to the amount by which your total interest inclusions on the bond in prior.

If a tax-exempt organization notifies you that part of the dues or other. IRS Publication 600. IRS Publication 600 was.

You will find details on 2020 tax changes and hundreds of interactive. See instructions V 21 Other expenses investment tax preparation safe deposit box etc. Additionally Blue Federal Credit Union matches all donations up to 80.

He died in 2021 with unpaid medical expenses of 1500 from 2020 and 1800 in 2021. Please note that 2022 is the default tax year used in the Alberta salary calculator you can select a different tax year in the advanced features of the salary calculator. Employers must pay mandatory deductions such.

List type and amount. The states official tax instruction book confirms union dues can still be deducted from state taxes subject to itemizing and if your miscellaneous deductions exceed two percent of your income. John properly filed his 2020 income tax return.

V 22 Add the amounts on lines 20 and 21. Please complete this T1 Organizer before your appointment. However if the taxpayer is self-employed and pays union dues those dues are deductible as a business expense.

You MUST attach Federal Form 2106 if required. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. Membership dues for trade unions or public servant associations may be deducted on income tax returns.

What are payroll deductions. Whether your donation is 10 or 10000 100 of your donation goes to important local causes. Payroll deductions determine an employees gross pay the amount of money written in their contract and net pay also known as take-home pay.

Payroll deductions are wages taken out of employees paychecks to pay for costs like payroll and income taxes employee benefits and more. To file a FSB claim you must submit a Family Supplemental Benefit Claim Form along with your itemized bill or. Dues used for lobbying.

A document published by the Internal Revenue Service IRS that provides information on deducting state and local sales taxes from federal income tax. In 2020 we gave more than 235000 back to our communities. PERSONAL TAX ORGANIZER.

For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Find forms instructions and publications. You and your eligible dependents may receive reimbursement for non-covered medically necessary and unreimbursed medical and dental that are considered deductible medical expenses by the IRS under the Family Supplemental Benefit FSB.

The Income Tax Act 1961 43 of 1961 Last Updated 13th December 2019 12607. Similar to the previous year union dues paid in 2019 are not deductible on miscellaneous deductions for federal taxes. Please attach all applicable slips receipts lists and other supplemental information.

Professionals who are required by law to pay dues for professional boards or parity or advisory committees may also deduct those fees. The Blue Foundation also helps make tax-deductible charitable giving easy for you. Actors pay taxes in the same way as any other employee who has earned money during the 2020 tax yearby filing a tax return with.

Typical deductible expenses for actors. We match your donations.

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Bill Seeks To Make Union Dues Tax Deductible Iam District 141

Revised Withholding Tax Table For Compensation Tax Table Compensation Tax

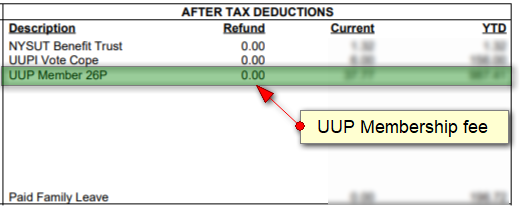

Deducting Union Dues On Nys Taxes Uup Buffalo Center

Deducting Union Dues Drake17 And Prior

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Union Fees Are They Tax Deductible And What Are They Pop Business

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

30 Truck Driver Tax Deductions Trucking Business Accounting Classes Business Classes

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

Union Payroll 101 Taxes And Fringes Union Dues Vacation Fund Fca International

Membership Dues Tax Deduction Info Teachers Association Of Long Beach

Solved Where Do I Enter New York State Teacher Union Dues For Nys Taxes

New Opportunity To Deduct Your Union Dues At Tax Time New York State Nurses Association